Pending home sales plunge to two-decade low

Mortgage rate surge triggers historic drop in pending sales in October.

With mortgage rates going off the charts, pending home sales fell to their lowest level in over two decades, according to the National Association of Realtors (NAR).

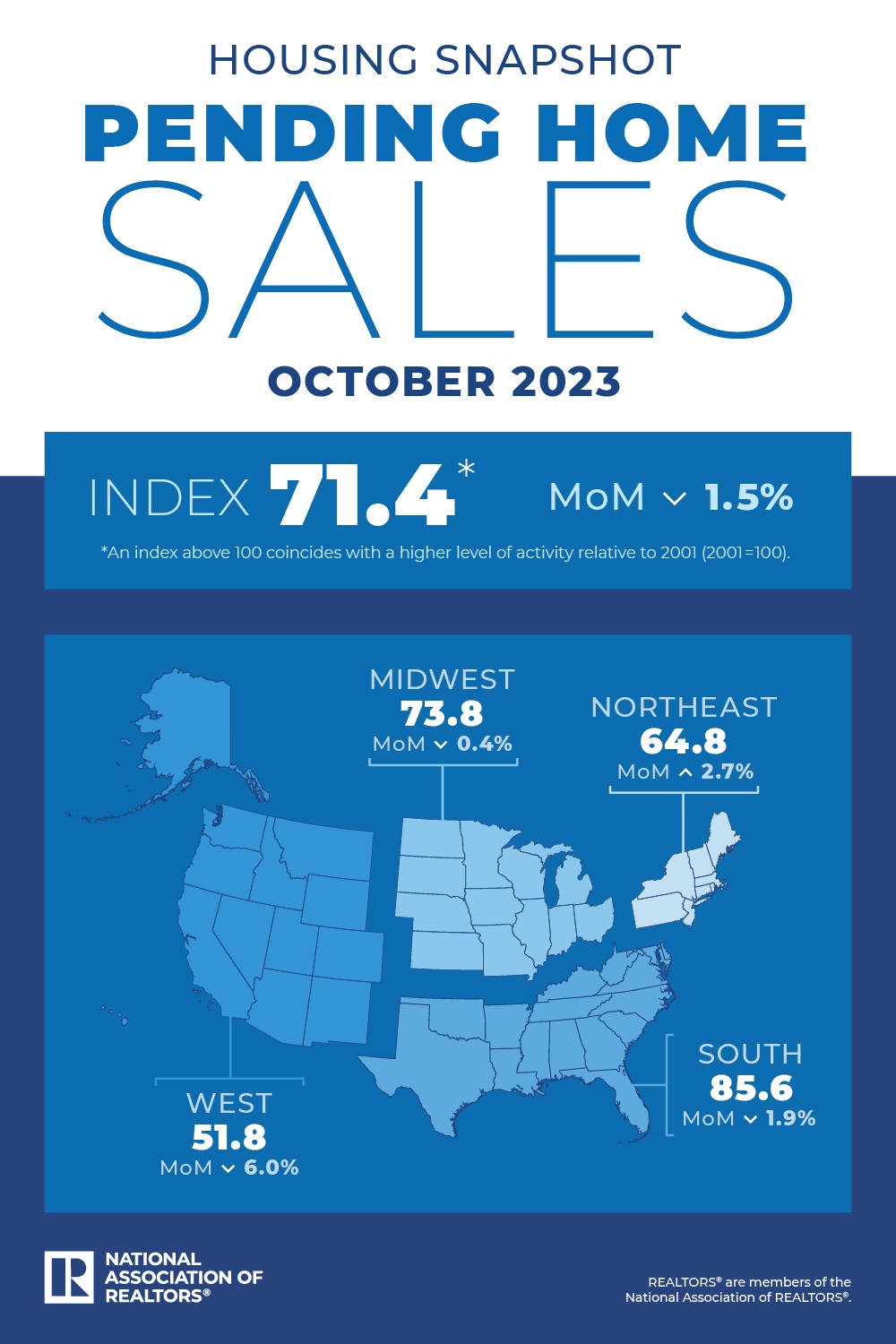

The number of contract signings for existing homes dropped 1.5% month over month and 8.5% year over year in October, bringing NAR's Pending Home Sales Index (PHSI) to 71.4 – the lowest since the trade association began keeping records in 2001.

Housing industry experts attributed this slump to October's peak mortgage rates.

"During October, mortgage rates were at their highest, and contract signings for existing homes were at their lowest in more than 20 years," NAR chief economist Lawrence Yun said in the PHSI report.

"Buyers and sellers are very mortgage-rate sensitive. Higher mortgage rates have had a dual impact on the housing market – reducing affordability for potential buyers and keeping sellers rate-locked in," said Odeta Kushi, deputy chief economist for First American.

Kate Wood, home and mortgage expert at NerdWallet, said the decline in pending sales may reverse as mortgage rates eased off throughout November.

"But given that inventory levels remain low and the real estate market generally slows heading into the holidays, pending home sales might not bounce right back from this low point," Wood noted.

"While there remains quite a bit of demand for homes on the sidelines, you can't buy what's not for sale, even if you can afford it," Kushi added.

"Home sales are rising in places where more inventory is available," Yun said. "Sales for properties priced above $750,000 were higher than a year ago because there is more inventory at this price point than what we saw last October. Additionally, newly built home sales are up 4.5% year-to-date due to homebuilders' ability to create more inventory. It is vital that we continue to focus on boosting housing supply by all means in all corners of the country over the coming months."

The regional breakdown of the PHSI presented a mixed picture. The Northeast experienced a 2.7% increase to 64.8 but still fell 6.5% from October 2022. The Midwest saw a slight 0.4% contraction to 73.8, a 10.3% drop year-over-year. The South's index declined 1.9% to 85.6, down 7.1% from the previous year, while the West faced a sharper 6.0% decline to 51.8, a 10.8% decrease from October 2022.

"Buyers continue to struggle with low inventory and affordability in many markets," said Keller Williams chief economist Ruben Gonzales. "Inventory levels are showing signs of increasing, but this varies by region. The Gulf Coast and Mountain West regions have the highest inventory levels, and the Northeast currently has the lowest. This year's pause in price growth created a window of opportunity for buyers with cash or large down payments, but that window now appears to be closing."

Related Posts

US existing-home sales plummet in October - Read The Story from November 29, 2023 »

DOJ eyes real estate broker commissions, NAR under scrutiny - Read The Story from October 23, 2023 »

Buyers of existing homes in the US hit pause amid elevated rates - Read The Story from September 30, 2023 »