Mortgage rates surge to new record high

The benchmark 30-year home loan rate climbs near 7%.

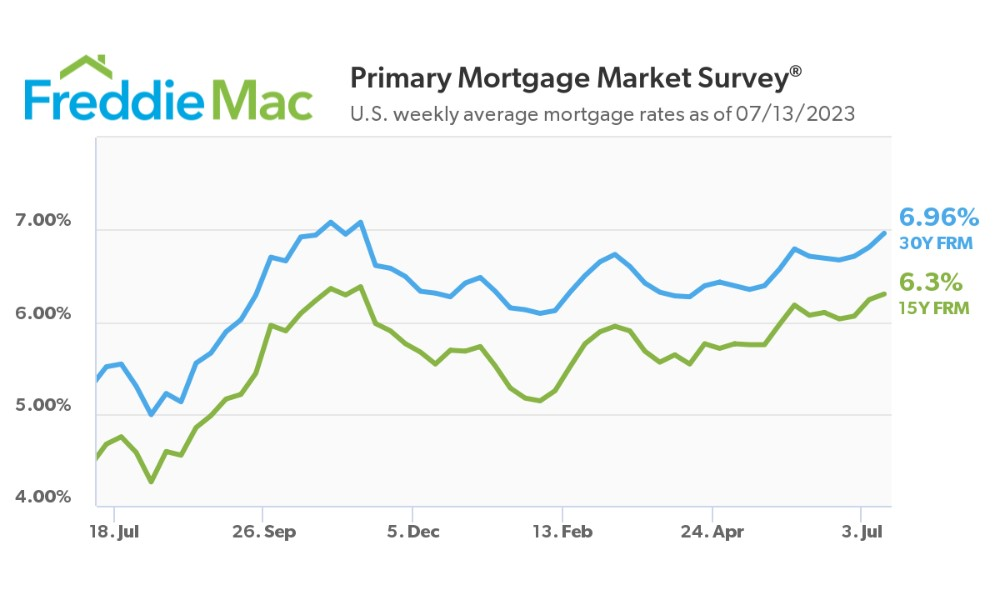

The average 30-year mortgage rate hit its highest level since November 2022, the last time it broke 7%, according to Freddie Mac.

Freddie Mac reported Thursday that the 30-year fixed-rate mortgage spiked 15 basis points to 6.96%, while the 15-year loan posted a six-basis-point increase to 6.30%.

“Incoming data suggest that inflation is softening, falling to its lowest annual rate in more than two years,” Freddie Mac chief economist Sam Khater said. “However, increases in housing costs, which account for a large share of inflation, remain stubbornly high, mainly due to low inventory relative to demand.”

Erin Sykes, chief economist at Nest Seekers International, commented: “The 30-year mortgage has hovered right around 7% for about nine months despite the Fed continuing to hike rates. My expectation is that it stays there for the foreseeable future with minor fluctuations higher/lower. This is in line with the 50-year average of 7.77%.”

“The Fed understands that fighting inflation is a bit like fighting a fire,” added Marty Green, principal at mortgage law firm Polunsky Beitel Green. “Just because the flames have calmed down, for now, doesn’t mean the ingredients for a flare-up aren’t still there. But the continued progress on the inflation front should relieve the pressure on the Federal Reserve to tighten interest rates further after the July increase, which should, in turn, have a positive impact on mortgage rates.”

Related Posts

Skyrocketing rates lead to sharp decline in mortgage applications - Read The Story from October 23, 2023 »

Long-term mortgage rates show no sign of slowing - Read The Story from October 22, 2023 »

Mortgage rates in the US now at highest levels for two decades - Read The Story from September 30, 2023 »