Home lenders maintain loose credit standards

Low credit availability driven by declining originations and shrinking industry capacity.

Mortgage companies maintained their loose lending standards in January as a way to “cope with lower volumes,” according to the Mortgage Bankers Association.

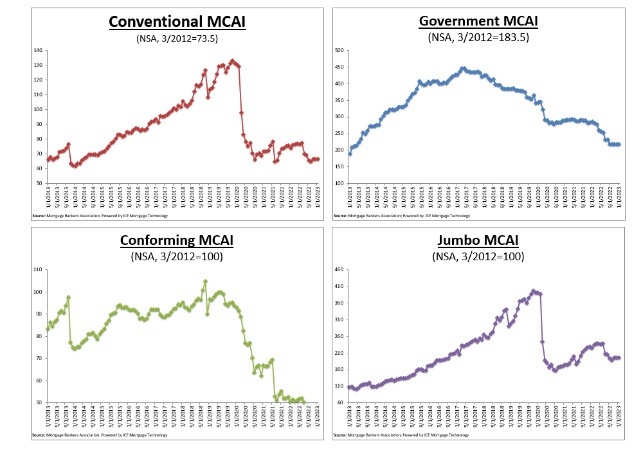

MBA’s Mortgage Credit Availability Index (MCAI) remained flat in January, dipping one basis point to a reading of 103.2. A decline in the MCAI, benchmarked to 100, indicates that lending standards are tightening, while increases in the index indicate loosening credit.

“Mortgage credit availability was essentially unchanged in January and remained close to its lowest level since 2013,” said Joel Kan, vice president and deputy chief economist of MBA. “Similar to December 2022, the availability of credit has been driven lower by declining originations and shrinking industry capacity as lenders have streamlined their operations to cope with lower volumes.”

Availability of conventional loans dropped 0.3%, while government mortgage credit supply remained unchanged. Of the component indices of the conventional index, the jumbo MCAI posted a 0.4% decrease, and the conforming MCAI stayed the same.

“As mortgage rates declined over the past month, the share of adjustable-rate mortgages has fallen – consistent with a slight pullback in ARM offerings in this month’s results,” Kan said. “However, there has been a revival in mortgage application activity over the past month, and our forecast is for rates to continue to decline and housing activity – including home sales and new home construction – to gradually pick up as we approach the spring homebuying season. These developments could potentially change the credit availability landscape in the months ahead.”

Related Posts

Skyrocketing rates lead to sharp decline in mortgage applications - Read The Story from October 23, 2023 »

Long-term mortgage rates show no sign of slowing - Read The Story from October 22, 2023 »

Mortgage rates in the US now at highest levels for two decades - Read The Story from September 30, 2023 »